Saskatchewan implements scaled-back expansion of provincial sales tax

Starting in October, Saskatchewan residents had to begin paying a sales tax for ticket admissions to sporting events, concerts and many other entertainment venues. This planned expansion of the Provincial Sales Tax was unveiled in early 2022, but more recently scaled back as part of the Government of Saskatchewan’s four-point “affordability plan” — for example, fitness and gym memberships were removed from the list of newly taxable services, as were recreational activities for young people.

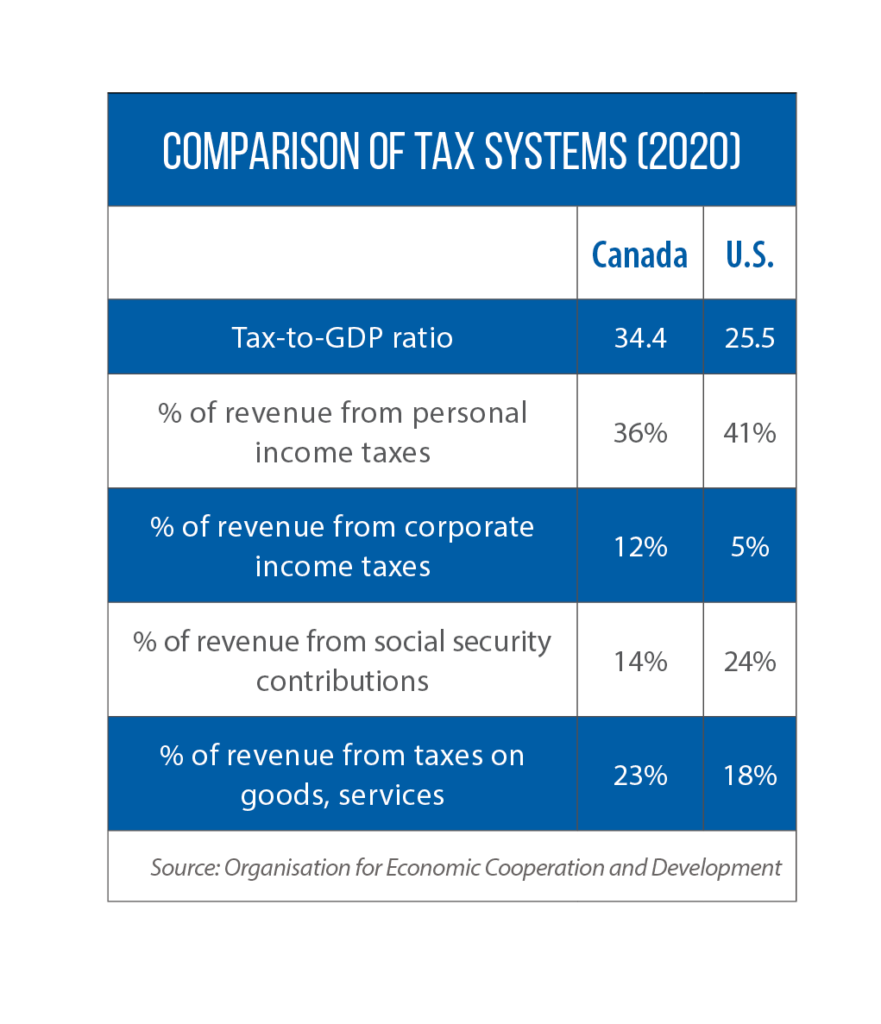

In Canada, events already are among the many service-related activities subject to the federal general sales tax, or GST. The GST is 5 percent; Saskatchewan’s PST is 6 percent. Five provinces, including Ontario (but not Saskatchewan), partner with the Government of Canada to levy a Harmonized Sales Tax, which combines the federal and provincial sales taxes. The HST is administered by the Canada Revenue Agency, with each province entering into an agreement with the federal government on what the tax base will be and how revenue will be shared.

In the United States, there is no national sales tax, though the federal government does collect excise taxes from sales of motor fuel, tobacco products, alcohol, and some health-related goods and services, according to the Tax Policy Center. At the state level, professional and large-scale events are typically subject to taxation. More generally, state systems vary widely on the taxation of services; a Federation of Tax Administrators survey from 2017 found that South Dakota collected revenue from more than 100 services, while Illinois, Michigan and North Dakota taxed fewer than 30.