More sports betting, more tax revenue for states — with three in Midwest near the top

During the last three months of 2023, state governments collected more than $758 million in taxes from sports betting, a 26 percent jump compared to the final quarter of 2022.

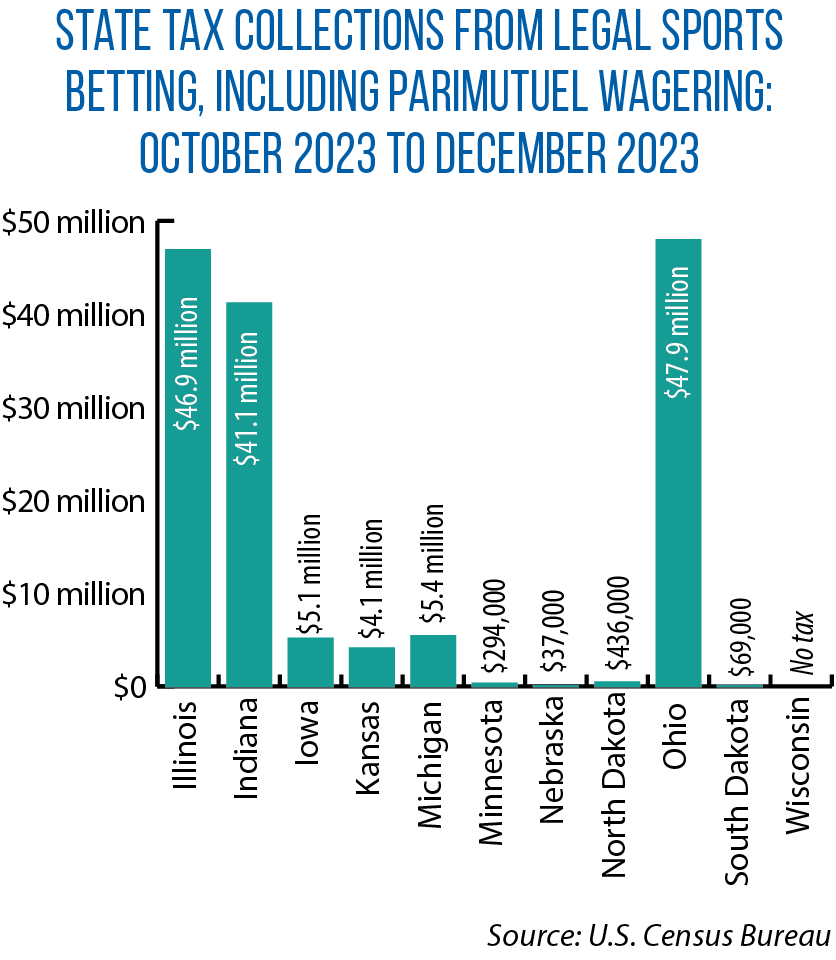

Among the states bringing in the most tax receipts: Ohio, Illinois and Indiana. Nationwide, only New York and Pennsylvania collected more than these three Midwestern states, which accounted for 90 percent of the total in this 11-state region (see bar graph for state-by-state information).

Among the states bringing in the most tax receipts: Ohio, Illinois and Indiana. Nationwide, only New York and Pennsylvania collected more than these three Midwestern states, which accounted for 90 percent of the total in this 11-state region (see bar graph for state-by-state information).

The end-of-year data comes from the U.S. Census Bureau’s “Quarterly Survey of State and Local Revenue.” With the exception of Wisconsin, every Midwestern state derived some revenue from sports betting, which includes parimutuel activities such as horse racing.

State legislatures have chosen different ways to use the influx of new revenue from sports betting, either targeting it for specific programs and services or using it for general-fund purposes.

As part of Ohio’s most recently enacted budget, legislators changed the allocation formula so that nearly all of the revenue from sports betting goes to general support for K-12 schools. Previous law had earmarked a portion of the money for K-12 athletics and extracurricular activities. The new budget also doubled Ohio’s sports gaming receipts tax rate, from 10 percent to 20 percent.

In Illinois, most of the money goes to capital infrastructure projects, and as of April, legislators were considering a proposal by Gov. J.B. Pritzker to increase the tax paid by sportsbooks from 15 percent to 35 percent. According to the American Gaming Association, the tax rate in Indiana is 9.5 percent, with most of the revenue going to the state general fund.

The association lists every Midwestern state except Minnesota as allowing sports betting (beyond parimutuel wagering). However, considerable variation exists in these authorization laws — for example, in some states, licenses are limited to Native American tribal operators, and only in-person (not mobile) wagering is permitted.