Future of carbon-capture pipelines runs through region’s legislatures

The idea seems simple: draw off the carbon dioxide (CO2) created during ethanol’s fermentation process at myriad Midwestern production plants before it enters the atmosphere and send it via pipelines to sequestration wells to be stored deep underground.

But two recent pipeline proposals faltered in the face of local opposition in the form of county-level setback requirements and landowners fighting the potential use of eminent domain. These developments drew attention from Midwestern legislators as they wrestle with both ongoing questions over the siting of pipelines and newer questions about whether and how to regulate CO2 sequestration.

For state policymakers, pipelines raise familiar, if thorny, questions about land access requirements, the use of eminent domain and where pipeline siting authority should lie, and newer ones such as whether to enact moratoria on CO2 pipeline construction pending new federal safety regulations.

In parts of the Midwestern region with the underground geology suited for sequestration, legislators are also discussing what their state’s sequestration policies should be.

Who, for example, owns underground “pore space” (the layers into which CO2 is injected)? Who owns sequestered CO2 after decades or even centuries? Is CO2 a commodity like oil or natural gas? The answers may go a long way toward determining the success of CO2 capture and sequestration, which now is a component of federal climate change policy.

Federal funding flows

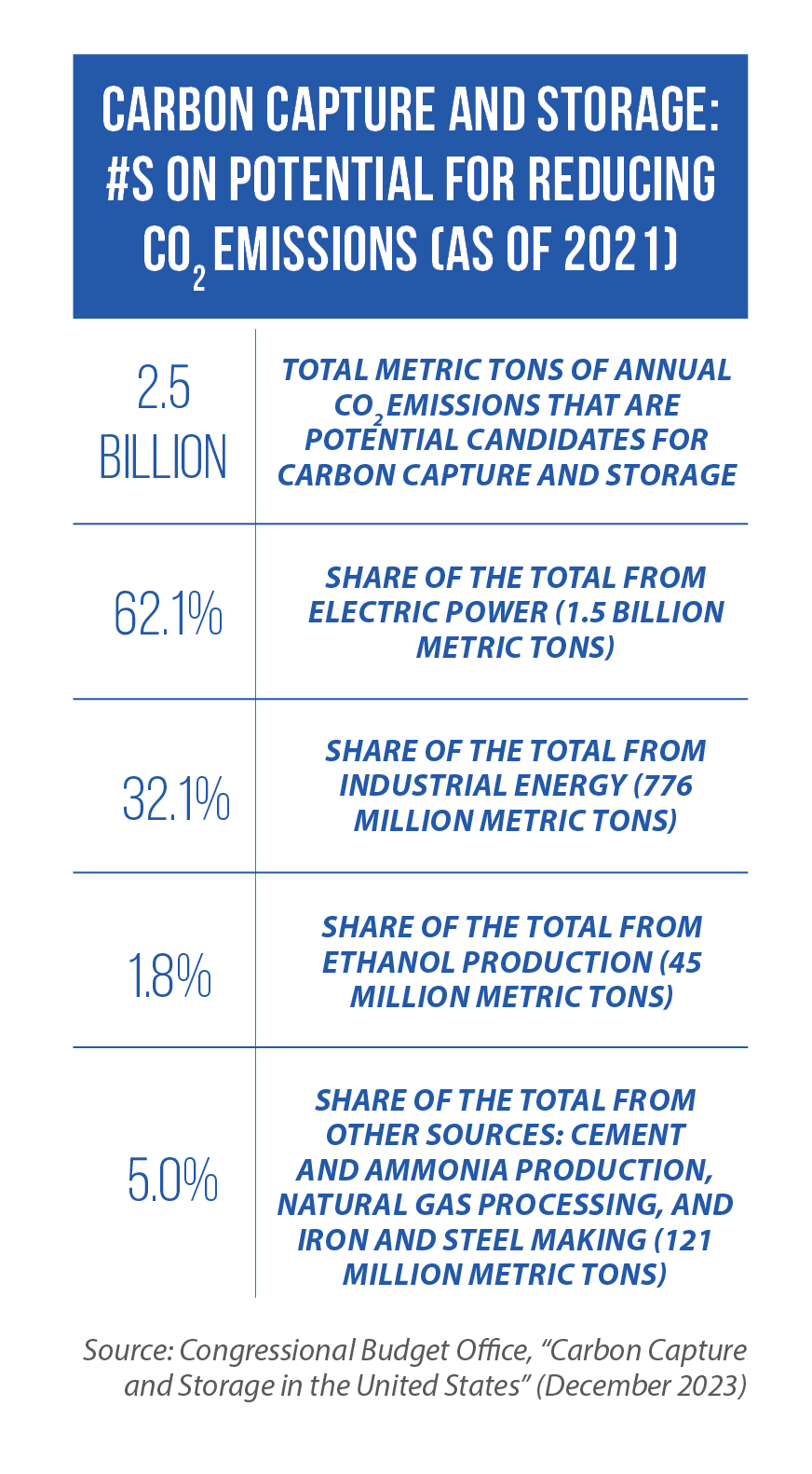

The Infrastructure Investment and Jobs Act of 2021 increased federal spending for carbon capture and sequestration from $2.7 billion in fiscal year 2022 to $4 billion in FY 2023.

This includes low-interest loans for eligible CO2 pipeline projects and funding for the development of facilities that capture CO2 from industrial production processes or directly from the atmosphere (known as “direct capture”).

The Inflation Reduction Act of 2022 increased a federal tax credit incentivizing carbon capture from $50 per ton to $80 for removal from industry and $180 for direct capture.

“That’s why we’re seeing all of the large pipeline projects that are being developed and proposed and discussed and causing a lot of emotion across [this] region of the country,” says Matt Fry, a senior policy manager at the Great Plains Institute.

“If we’re going to actually address climate impacts, we’re going to have to capture and store these large volumes of CO2. They have to get that captured CO2 to a geology where it can actually be stored.”

New laws in South Dakota

In October 2023, citing “the unpredictable nature of the regulatory and government processes,” Navigator CO2 Ventures canceled plans for a 1,300-mile pipeline to carry CO2 from 20 ethanol plants in Iowa, Minnesota, Nebraska and South Dakota to a sequestration site in Illinois.

Also last year, Summit Carbon Solutions hit regulatory roadblocks when the North Dakota and South Dakota public service commissions both rejected its initial permit applications for a 2,000-mile pipeline to carry CO2 from 34 ethanol plants in five different Midwestern states to a sequestration site in western North Dakota.

The company said it would refile its South Dakota application and, as of March, was waiting for a decision from the Iowa Utilities Board following hearings held in November.

The proposal also led South Dakota legislators to consider nine pipeline-related bills during their 2024 legislative session, of which three became law:

- SB 201 specifies that the South Dakota Public Utilities Commission has siting authority for pipelines, and allows counties to levy a new surcharge of $1 per linear foot of pipeline on CO2 pipeline operators. This revenue will be split: half as property tax relief for affected property owners, and half to be allocated as determined by the county.

- HB 1185 changes the process for notifying landowners of surveys for “proposed facilities” and requires a new one-time payment of $500 to the landowner for access to their property (separate from payments that may be required for property or crop damage).

- HB 1186 limits CO2 pipeline easements to 99 years and voids the easement if a pipeline is not in operation five years after the easement is recorded. Easements are also voided after five years of nonuse at any time after the Public Utilities Commission issues a permit.

South Dakota legislators also codified a 15-part landowner “bill of rights” (SB 201) covering issues ranging from liability to repairing any property damage.

South Dakota legislators also codified a 15-part landowner “bill of rights” (SB 201) covering issues ranging from liability to repairing any property damage.

South Dakota House Majority Leader Will Mortenson, an agricultural real estate attorney, says many of the provisions now in state law have many of the same terms that he has negotiated for individual clients dealing with pipeline companies.

“To a pretty large extent, I viewed every landowner in the state as my client, and it’s my job to go in and negotiate them the best terms I could from the position I was in,” he says.

Senate Majority Leader Casey Crabtree says the new laws resulted from conversations over the previous 12 months among landowners, agricultural producers, the agriculture industry, utilities and other stakeholders.

The linear-foot surcharge and access fee are new policies for South Dakota, he says, but are a recognition that there is a cost to landowners and counties where pipelines get installed.

The linear-foot surcharge and access fee are new policies for South Dakota, he says, but are a recognition that there is a cost to landowners and counties where pipelines get installed.

Mortenson says those provisions also reflect the fact that the use of CO2 pipelines to sequester the gas underground is “fundamentally different” from using pipelines to move commodities like oil or natural gas from the ground to market.

“That’s why we have different regulations, different accommodations,” he says, “and we require a higher level of public benefit to the landowners and the counties, and everyone along the route.”

Part of the answer …

The destinations for all carbon pipelines are wells that inject CO2 into deep rock formations. These wells are known as “Class VI” wells, a designation in the U.S. Environmental Protection Agency’s Underground Injection Control program. This program aims to protect underground sources of drinking water.

The wells send CO2 a mile or more deep into strata of porous rock underneath a layer of non-porous “cap” rock that blocks the gas from returning to the surface. Such formations underlie most of the Midwest, according to the U.S. Department of Energy’s most recent “Carbon Storage Atlas” (released in 2015).

One of the nation’s first CO2 sequestration test sites came online in November 2011 at an ethanol production plant in Decatur, Ill. By November 2014, more than 1 million tons of CO2 from that plant had been injected into a sandstone layer. Monitoring is ongoing. Another test site is operating in northern Michigan.

A December 2023 Congressional Budget Office report notes there are 15 sequestration sites operating nationwide, seven of which are in Illinois, Michigan, Kansas and North Dakota.

Fry cites a North Dakota law from 2010 and a newer Indiana law (HB 1209 of 2022) among model frameworks for developing CO2 sequestration sites. Additionally, Nebraska enacted the Geologic Storage of Carbon Dioxide Act (LB 650) in 2021.

All three laws address ownership of underground pore space and require operators to pay fees into a fund to help defray monitoring costs even after a sequestration site closes — a key step to maintaining safety into the future, Fry says.

This year, Illinois legislators have been mulling a trio of bills (SB 2421 and HB 3119, and HB 569) to establish a similar framework. These bills would also ban the use of eminent domain to access surface property.

Indiana Rep. Ethan Manning, a co-chair of The Council of State Governments’ Midwestern Legislative Conference Energy & Environment Committee, says his state’s HB 1209 was designed with the future in mind.

“We set the rules so everyone knows what they need to do, we provide a way for the companies themselves to pay into [a trust fund managed by the Department of Natural Resources], so it’s self-funding,” he says. “Then we say what happens after a project is complete and the state eventually takes over, so even if BP or any other company doesn’t exist in 50 or 100 years, there is oversight of these wells and what’s happening 5,000-10,000 feet below our feet.”

…Or a ‘fig leaf’?

Not everyone is convinced that CO2 sequestration is viable.

In a December opinion piece published in Scientific American, Jonathan Foley, executive director of Project Drawdown, a nonprofit organization focused on stopping climate change, said industrial-scale sequestration can do no more than remove “a few seconds’ worth of our yearly greenhouse gas emissions,” removing a few million metric tons when global carbon emissions in 2023 were 40.5 billion tons.

Moreover, he said, the technology is too expensive compared to other climate solutions and, if used to extract more oil and gas, defeats its very purpose.

Overview of other recent carbon pipeline and sequestration legislation

in the Midwest

Pipeline moratoria or bans

- Illinois — Impose moratorium on construction of CO2 pipelines for four years or until enactment of new federal safety regulations (HB 4835 and SB 3441 of 2024)

- Iowa — Ban issuance of permits for CO2 pipelines and prevent granting the right of eminent domain (HF 576 of 2023)

- Nebraska — Ban transportation of CO2 in a pipeline (LB 1140)

Protecting landowners from eminent domain

- South Dakota‘s HB 1256 and Iowa’s HF 565 (from 2023) would have required pipeline operators to get voluntary easements from 90 percent of landowners on their proposed routes before using eminent domain to secure the rest.

- Iowa — Allow court challenges to projects using eminent domain prior to issuance of state permit (HF 2664 of 2024)

- South Dakota — Bar use of eminent domain for CO2 pipelines (HB 1219 of 2024)

Carbon sequestration policy

- Illinois — Establish a legal framework for se questration: ownership of pore space, banning the use of eminent domain, and establishing funds and assessing fees for long-term monitoring (HB 569, HB 3119, and SB 2421 of 2024)

- Indiana — Establishes a legal framework for sequestration, including ownership of pore space as well as new funds and fees for long-term monitoring (HB 1209 of 2022; signed into law)

- Iowa — Require CO2 pipeline operators to permanently sequester the gas and show that their project will “result in a significant reduction” in atmospheric CO2 (HF 682 of 2024)

- Michigan — Defines carbon sequestration as a “clean energy system” if it is 90 percent effective in capturing and storing CO2 and is not used for enhanced oil recovery (SB 271 of 2023 session; signed into law)

- Minnesota — Declare as state policy support for development and deployment of CO2 capture and sequestration technologies as way to reduce greenhouse gas emissions (HF 342/SF 298 of 2023)

- Ohio — Declare intent to establish a CO2 capture and sequestration framework; specify that capture and storage technologies encompass both industrial emissions and direct capture (HB 358 and SB 200 of 2023)