Bipartisan legislation in Wisconsin boosts incentives to invest in federally designated Opportunity Zones

As of early March, Wisconsin was set to become one of the first states in the nation to expand incentives for private investments in federally designated Opportunity Zones. Under AB 532, which passed with bipartisan support in the Assembly and Senate, Wisconsin would double the tax credits for investors supporting projects in financially strapped, low-income communities across the state. (The bill had not yet been signed by the governor as of early March.)

Opportunity Zones were established by the U.S. Congress three years ago. Under that 2017 law, governors submit lists of low-income census tracts to be identified as Opportunity Zones. Through federal tax incentives, investors are then encouraged to reinvest unrealized capital gains into development projects in these areas. In particular:

Opportunity Zones were established by the U.S. Congress three years ago. Under that 2017 law, governors submit lists of low-income census tracts to be identified as Opportunity Zones. Through federal tax incentives, investors are then encouraged to reinvest unrealized capital gains into development projects in these areas. In particular:

- A deferral of federal taxes on any recent capital gains until 2026.

- A reduction of capital gains tax payment by up to 15 percent (10 percent if the investment is held for five years, and an additional 5 percent if held for at least seven years).

- An elimination of taxes on potential profits from an Opportunity Fund if the investment is held for 10 years. (An Opportunity Fund is an investment vehicle for business investments in these zones.)

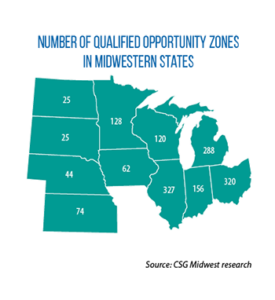

Up to 25 percent of a state’s census tracts that qualify as low income (along with a limited number of contiguous census tracts) can be submitted for designation. Nationally, there are now more than 8,700 Opportunity Zones.

In Wisconsin, which has 120 designated zones, lawmakers saw an opportunity to build on the federal program. AB 532 doubles the state’s Opportunity Zone tax exclusion for investors who invest in an Opportunity Fund. Under the legislation, investors receive an additional 10 percent state capital gains tax reduction if they hold an investment in a Wisconsin Qualified Opportunity Fund for at least five years, and an additional 15 percent after seven years.

“We should be doing what we can to incentivize investment in Wisconsin, and this bill does that,” says Rep. Nancy VanderMeer, sponsor of the legislation. Eligible projects include commercial and residential real estate development, new business ventures, and the expansion of existing operations.

“One of the things that stood out to us here is that we’re incentivizing private capital investment and not spending tax dollars,” VanderMeer adds. Another plus: Opportunity Zones cover a diverse group of communities. For example, nearly 30 percent of them are in Wisconsin’s rural areas.

“[It] is incentivizing private capital to areas of the state that might not otherwise garner investment,” she says, adding “there’s a somewhat rare rural and urban appeal to the proposal.”

“I’m always thinking about how to drive investment to rural areas, and economic development in general,” VanderMeer says. “This legislation is a unique way to do that, especially utilizing an already existing program and structure set up at the federal level.”

“The most typical type of investment that has been and will be utilized in the program is real estate investment, both residential and commercial,” she adds. “That might mean a new apartment complex, a business expansion or investment in a new mixed-use retail-residential building.”