Question of the Month | October 2021 | How states adopt revenue estimates

In the 11-state Midwest, who establishes the official revenue estimate that guides the development of state budgets?

States use a mix of approaches, but in this region, the “who” always includes either members of the executive branch or their designees. The legislative branch also often has a role in the development of official revenue estimates.

Five Midwestern states, for instance, have statutory language calling for an inter-branch, consensus approach to this part of the budget process.

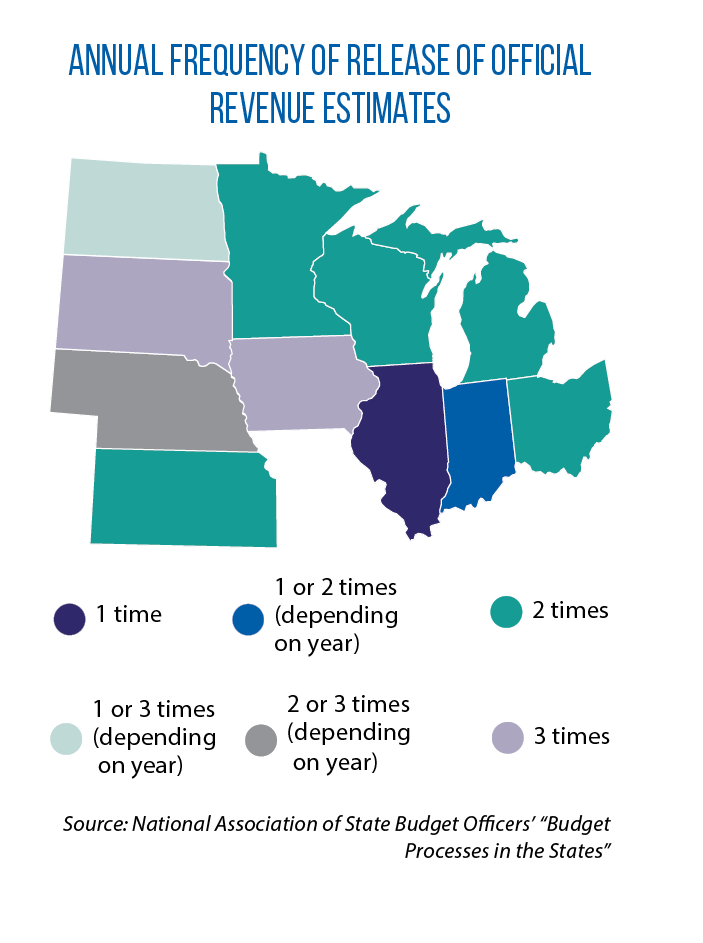

- Indiana’s Revenue Forecast Technical Committee is responsible for developing the official estimate. It includes two members appointed by the governor and four appointed by the state’s legislative caucuses. The committee meets every December, as well as in April in years when the state’s biennial budget is passed.

- Under Iowa statute, a Revenue Estimating Conference must meet at least three times a year, including once immediately before and once during legislative session. The conference is made up of a governor’s designee, a staff person with Iowa’s Legislative Services Agency and a third person agreed upon by the two other members.

- In Kansas, staff from the Legislative Research Department, Division of Budget and Department of Revenue develop a joint estimate twice a year with assistance from three university economists. Each member of this Consensus Estimating Group uses his or her own model to develop an estimate. The group then discusses each member’s findings before issuing a single revenue estimate.

- The Michigan House Fiscal Agency, Senate Fiscal Agency and Department of Treasury are involved in the state’s twice-a-year revenue estimates. Each develops its own forecast. After reviewing these three forecasts, as well as hearing presentations from outside experts, representatives from these agencies agree on a joint economic/revenue forecast.

- Nebraska’s law differs from many other states in that it establishes qualifications to serve on the Economic Forecasting Advisory Board. The nine members must have “demonstrated expertise in the field of tax policy, economics or economic forecasting.” Five are appointed by the Legislature, four by the governor. They meet three times in odd-numbered years and twice in even-numbered years.

In contrast to these five states, Minnesota leaves revenue estimating to the executive branch. A state economist within the Department of Management and Budget prepares twice-a-year revenue estimates for the governor and Legislature. A Council of Economic Advisers reviews the assumptions and methodologies used by the department.

In other states, separate or competing revenue forecasts are established by the legislative and executive branches. For example, early in session, the South Dakota Legislature’s Joint Committee on Appropriations votes on a “revenue target” after hearing independent estimates prepared by the two branches.

In states such as Illinois, Ohio and Wisconsin, the governor’s proposed budget is based on revenue estimates generated by executive departments or agencies. However, lawmakers also can use forecasts developed independently by legislative fiscal staff.

Revenue forecasting in North Dakota is led by the Office of Management and Budget, with an interim legislative committee in place to scrutinize the executive branch’s data, models and findings. The legislative branch also conducts economic forecasting of its own. Many states also report using economic consulting firms to help establish their estimates.

Question of the Month highlights an inquiry sent to the CSG Midwest Information Help Line, an information-request service for legislators and other state and provincial officials from the region.