Question received by CSG Midwest: Do any states in the region provide tax credits to renters?

Answer provided by CSG Midwest

Among the 11 states in the Midwest, at least six offer some kind of tax credit or deduction for renters. These programs often limit eligibility based on factors such as household income, age and/or disability.

Michigan’s assistance is provided as part of its homestead property tax credit. For renters with an annual income of $60,600 or less, some kind of credit may be available. The exact amount is calculated based on the household’s total resources and the rent paid. Under current law, a larger credit typically is available for the disabled or people 65 or older. In recent years, the maximum renters tax credit in Michigan has been $1,500, but it may increase due to statutory language that allows for inflation-based changes in this cap.

In Wisconsin, the renters credit in tax year 2021 was available for households with incomes of $24,679 or less. The maximum credit is capped (at $1,168), and the exact amount available to each renter is based on his or her income and the rent paid. A provision in the Wisconsin law requires filers to have earned income in order to qualify for the renters tax credit (exceptions are made for the disabled and individuals 62 and older). In addition, the amount of the credit may be reduced for renters receiving certain types of public assistance.

The programs in North Dakota and Iowa are only for senior citizens and the disabled.

A refund of up to $400 is available in North Dakota for senior or disabled renters who meet the following criteria: their yearly income does not exceed $42,000, and 20 percent of their annual rent exceeds 4 percent of their annual income.

Iowa funds a “reimbursement” of up to $1,000. To qualify in tax year 2021, the renter’s income had to be less than $24,354. An individual is eligible for a credit equal to 23 percent of the total rent that he or she paid. A sliding income scale also is used: The higher the renter’s income (up to the $24,354 threshold), the less the credit.

Indiana does not have age, disability or income restrictions; it offers a tax deduction of $3,000 to renters.

This year in Minnesota, legislators contemplated several changes to the state’s renters tax credit, but these proposals (part of HF 3669) failed to pass prior to adjournment. Under current law, renters must get a “certificate of rent paid” by their landlord and then seek reimbursement through the state’s property tax relief fund. Among this year’s legislative proposals: simplify the process for renters by providing the relief as a refundable income tax credit. Other changes would have expanded eligibility and offered larger refunds, according to the Minnesota Budget Project, a nonpartisan initiative of nonprofit groups in the state.

In tax year 2021, Minnesota renters with incomes of less than $64,920 were eligible for the existing credit. According to research done by the Minnesota House, more than 314,000 renters received refunds in 2018. The average refund was $690 (it was higher for seniors and the disabled). The maximum refund in tax year 2020 was $2,210.

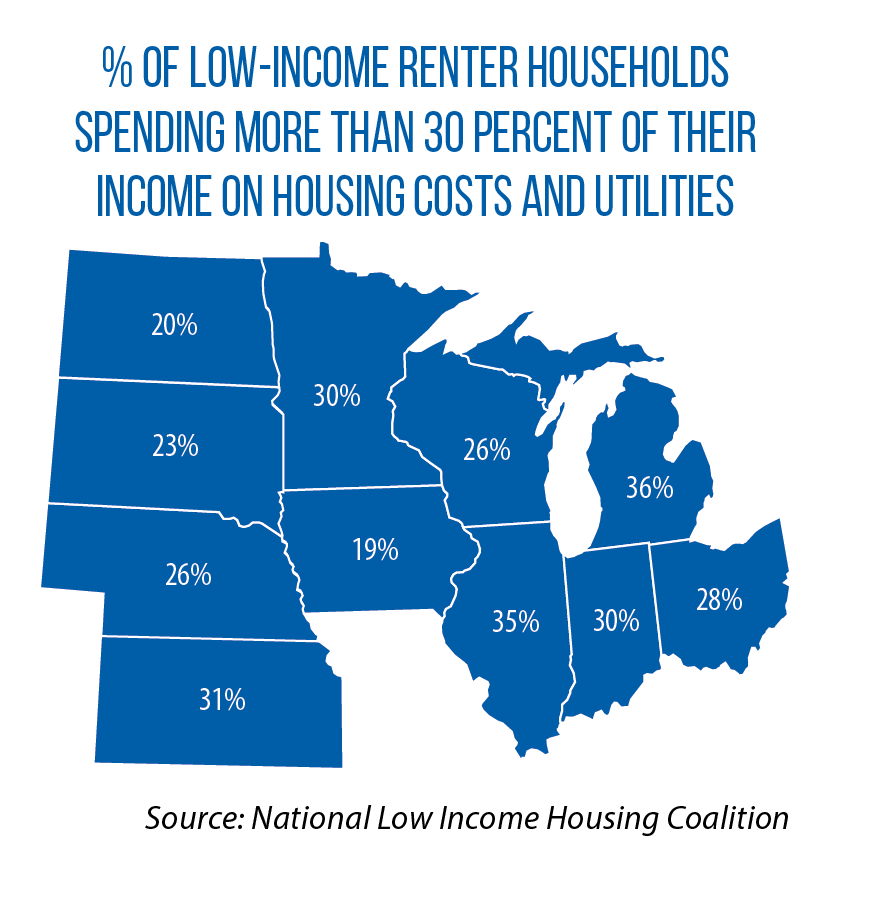

Legislation has been introduced in the U.S. Congress to provide for a federally funded, state-administered renters tax credit. The credit would go to building owners who rent to low-income tenants. To qualify for the credit, a building owner would need to keep the amount paid by tenants (in rent and utilities) below 30 percent of their incomes.

This post is based on an inquiry sent to the CSG Midwest Information Help Line, an information request service for legislators and other state and provincial officials from the region.