North Dakota shifts to defined-contribution model for public employee retirement system

Starting in 2025, North Dakota will be closing its defined-benefit pension plan for many newly hired public employees, who will instead be enrolled in a 401(k)-style defined-contribution plan.

Supporters of the new law, HB 1040, say the change will help address the state’s long-term unfunded pension liabilities, which stand at $1.9 billion in the North Dakota Public Employees Retirement System, or NDPERS. (This system does not include teachers.) North Dakota legislators also injected $200 million into NDPERS.

Opponents of HB 1040 say that by closing the defined-benefit system for new employees, the state will no longer have an important source of money to pay the benefits of retirees — namely, the pension contributions of those new workers. They argued that a better legislative solution was to shore up, but keep, the existing system.

Opponents of HB 1040 say that by closing the defined-benefit system for new employees, the state will no longer have an important source of money to pay the benefits of retirees — namely, the pension contributions of those new workers. They argued that a better legislative solution was to shore up, but keep, the existing system.

Defined-benefit plans remain the predominant model for state retirement systems. However, more and more states are trying new approaches. According to a September 2023 study by the National Association of State Retirement Administrators, five Midwestern states now use some kind of “hybrid” model in one or more of their systems: “cash balance” plans in Kansas and Nebraska (a worker accrues money in an account, which converts to an annuity upon his or her retirement), or a combination of defined-benefit and defined-contribution plans in Indiana, Michigan and Ohio. Among those five states, Indiana has the highest percentage of public employees participating in a hybrid plan, the association found.

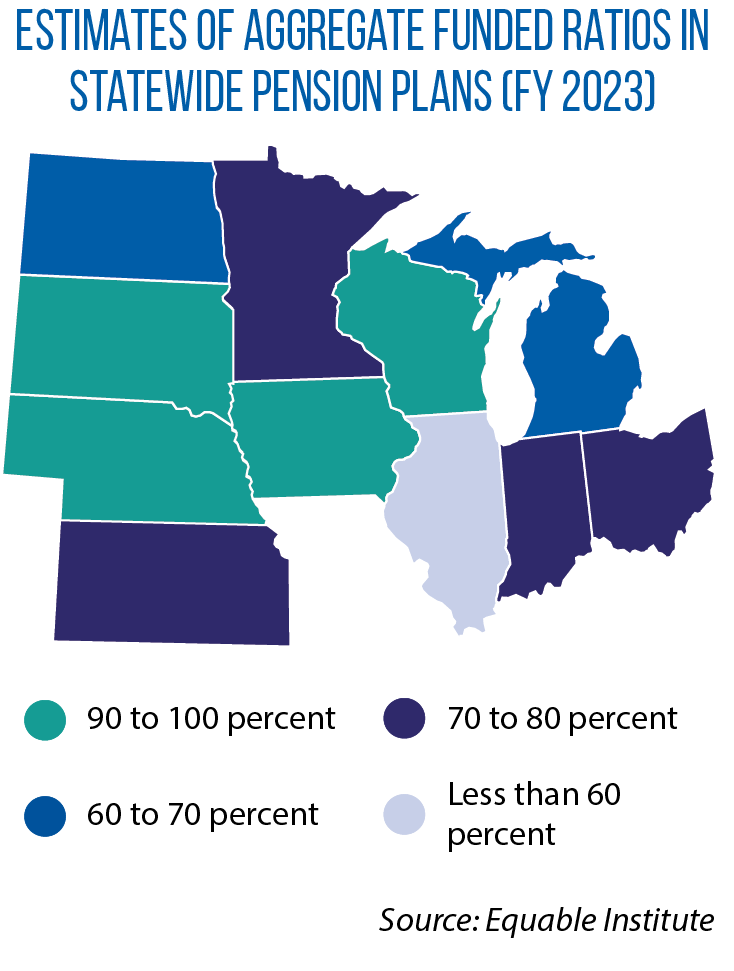

In a recent national study, the Equable Institute estimates that the average funded ratio among the nation’s largest state and local pension plans in 2023 is 77.4 percent, up from 75.4 percent in 2022.

The funded ratio is the value of assets in a pension fund divided by the value of promised lifetime income benefits, and it varies considerably from state to state (see map). The institute classifies the statewide pension plans of Iowa, Nebraska, South Dakota and Wisconsin as “resilient” because they have funding ratios of 90 percent or more. All other statewide systems in the Midwest are classified as “fragile” (ratios of between 60 percent and 90 percent) or “distressed” (under 60 percent).