Minnesota, Wisconsin among states with new tax credits for families

Already one of six states that builds off the federal Child and Dependent Care Tax Credit, Wisconsin is now expanding the reach of its state-level credit as the result of AB 1023, a measure that passed with near-unanimous legislative support and was signed into law in March.

The credit reimburses qualifying families for child care expenses incurred while parents or guardians work or look for work. The amount of Wisconsin’s credit has been raised from 50 percent to 100 percent of the federal Child and Dependent Care Tax Credit; additionally, the maximum amount of qualifying child care-related expenses was increased from $3,000 to $10,000 for one qualifying dependent and from $6,000 to $20,000 for two or more qualifying dependents.

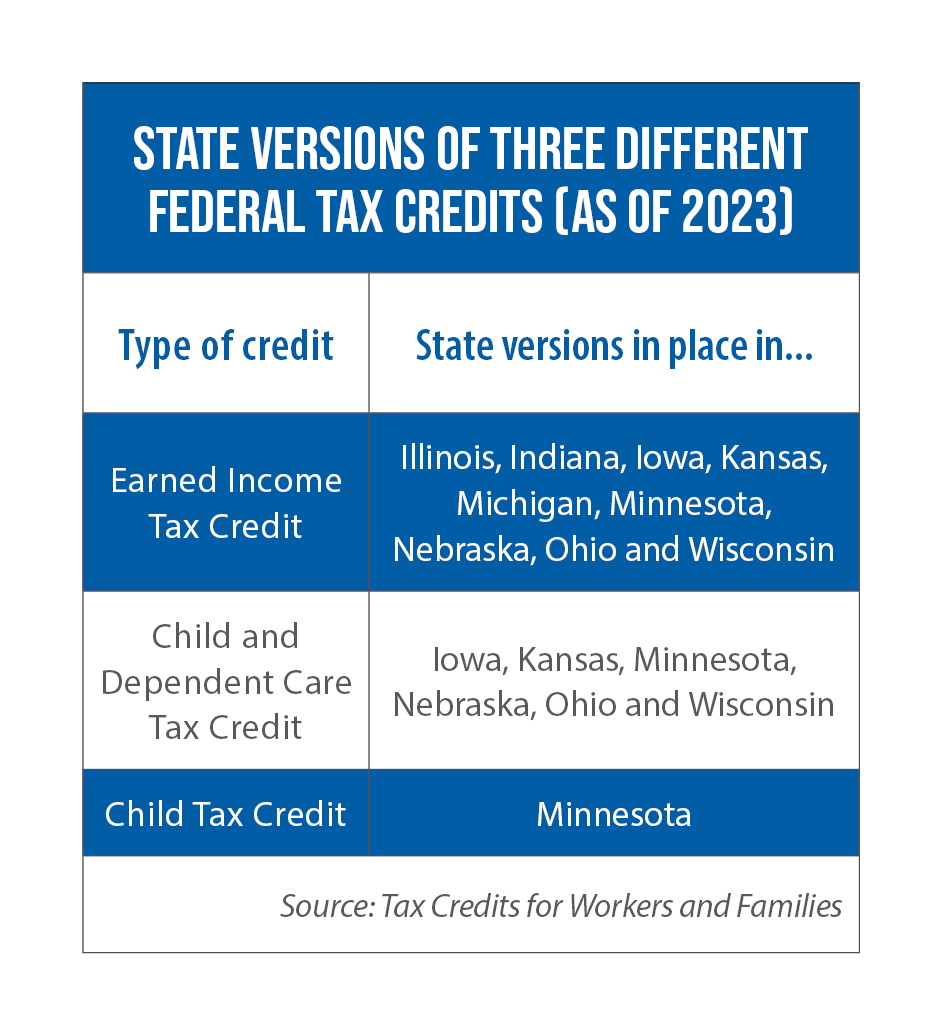

AB 1023 is one example of legislative steps being taken by Midwestern states to implement or expand their own versions of federal tax credits for working families. Several states in the region provide for earned income tax credits, and Michigan expanded its EITC in 2023 with the passage of HB 4001. Under the new law, Michigan’s EITC jumped from 6 percent to 30 percent of the federal credit.

Last year, Minnesota became the first Midwestern state to establish a Child Tax Credit (HF 1938). The maximum amount of the credit is $1,750 per child, and there is no limit on the number of children, age 17 and under, that can be claimed. However, various income thresholds are set. For married couples who file jointly, the credit begins to be phased out starting with incomes of $35,000 a year, and it is not available for higher-earning families; for example, married couples who file jointly, have two children and make more than $96,245 annually do not qualify.

In April, Minnesota Gov. Tim Walz said the average credit for families thus far has been $2,508. This year’s HF 4823 would extend Minnesota’s Child Tax Credit to 18-year-olds.