High budget reserves trigger automatic refund in 2022 for Indiana taxpayers

Coming soon to every Indiana resident who files income taxes for 2021: a refund from the state of $125. Under a law that dates back to 2011, the delivery of such a tax refund is automatically triggered when the state ends a fiscal year with reserves that meet or exceed 12.5 percent of general fund spending.

According to The Indianapolis Star, Indiana closed the books on 2021 with nearly $4 billion in reserves. State law calls for “excess” reserves to be split evenly between sending a refund to taxpayers and depositing money into a teacher pension stabilization fund. An estimated $545 million in tax refunds will be returned to more than 4 million residents.

In advance of the start of legislative session in Kansas, Gov. Laura Kelly proposed using a portion of the state’s budget surplus to provide a one-time rebate of $250 to all residents who file a 2021 income tax return ($500 for joint filers).

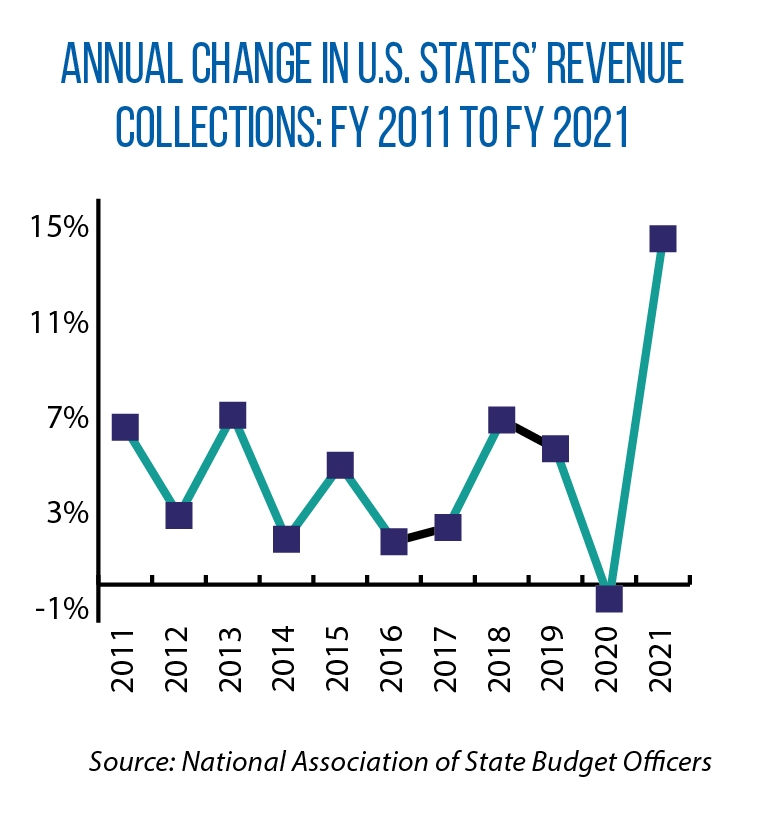

A December 2021 report from the National Association of State Budget Officers highlights the strength of budget conditions: a 14.5 percent increase in U.S. states’ general-fund revenues between fiscal years 2020 and 2021, and record-high balances in rainy day funds. Across the 50 states, the median balance as a share of general funding is 9.4 percent.